Updated filing guidelines for BIR Forms 1604C, 1604F and 1604E; submission of BIR Form 2316 without employee signature shall be accepted

(Revenue Memorandum Circular No. 18-2021 issued on February 02, 2021)

This Tax Alert is issued to inform all concerned taxpayers on the clarifications of certain issues and concerns in the filing of BIR Form Nos. 1604C, 1604F and 1604E and submission of BIR Form 2316 to the BIR.

Filing of BIR Form 1604C, 1604F and 1604E

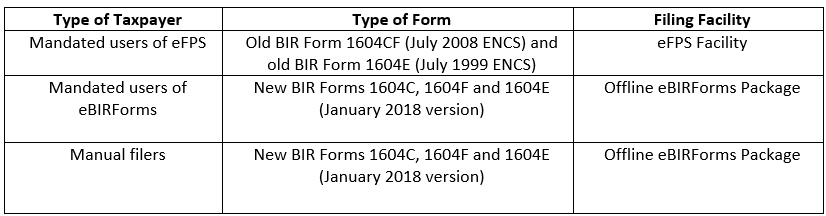

BIR Forms 1604C, 1604F and 1604E for the year 2020 shall be filed as follows:

eFPS filers shall use the new forms in the offline eBIRForms package in case of unavailability of the eFPS system.

Taxpayers who have already filed their tax returns through eFPS and eBIRForms Package need not submit hard copies of the returns to the RDO where they are duly registered.

Submission of BIR Forms 2316

The BIR shall accept Certificate of Compensation Payment/ Tax Withheld for Compensation Payment With or Without Tax Withheld (BIR Form No. 2316) without the signature of the concerned employee provided that the certificates are duly signed by the authorized representative of the taxpayer-employer.

Download