RPT Form (BIR Form 1709) may now be filed either manually or through the eAFS facility; other clarifications on the filing of attachments thru eAFS

(Revenue Memorandum Circular Nos. 43 and 44-2021, April 08, 2021)

This Tax Alert is issued to inform all concerned taxpayers on the clarifications on the filing of Information Return on Transactions with Related Party (BIR Form 1709) and other attachments to the annual income tax return (AITR).

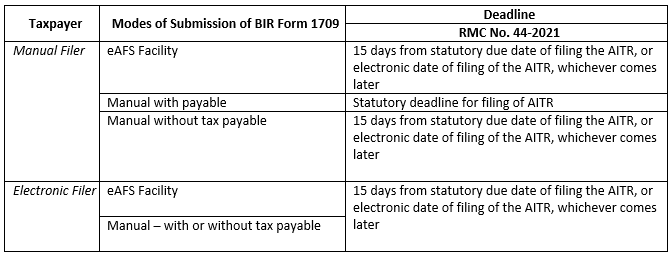

Pursuant to RMC No. 44-2021, taxpayers may file their RPT Form/BIR Form 1709, as follows:

Specifically, for the fiscal year ended November 30, 2020 and calendar year ended December 31, 2020, RMC No. 98-2020 provides that the extended deadline for the submission of BIR Form 1709 is April 30, 2021.

For the file naming convention to be observed in the filing of BIR Form 1709 and other attachments through the eAFS facility, please refer to the full text of RMC No. 43-2021:

(https://www.bir.gov.ph/images/bir_files/internal_communications_2/RMCs/2021%20RMCs/RMC%20No.%2043-2021%20revised.pdf)