Reportorial requirements on the exemption from DST for qualified loans pursuant to Bayanihan to Recover as One Act (RA 11494)

(Revenue Memorandum Circular Nos. 22 and 26-2021 issued on February 18, 2021 and February 24, 2021)

This Tax Alert is issued to inform all concerned taxpayers on the prescribed reportorial requirements to be submitted by covered institutions’ DST exemption of loan term extensions and credit restructuring pursuant to relief for loans falling due on or before December 31, 2020 under Bayanihan to Recover as One Act (Republic Act No. 11494) or the Bayanihan II.

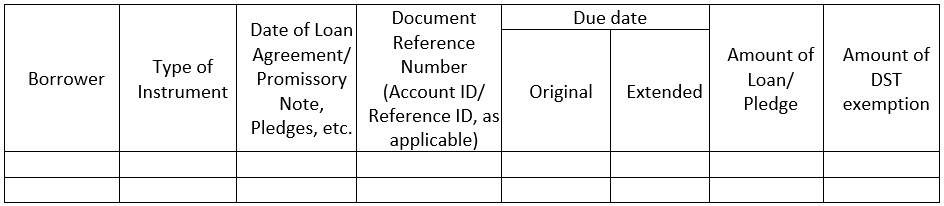

Covered institutions shall submit, in soft and hard copy, a summary of listing of all pre-existing loans, pledges and other instruments as of the effectivity of RA 11494 on September 15, 2020 which were granted extension of payment and/or maturity periods based on the format below:

The summary listing shall be submitted to Revenue District Office (RDO)/ Large Taxpayers Service/ Large Taxpayers District Office where the taxpayer is registered not later than March 31, 2021. The hard copy shall be made under oath as to the completeness, truth and accuracy by a duly authorized officer or representative of the taxpayer, and subject to post audit/verification by the BIR.

In case of failure to submit the summary listing required on the date prescribed, administrative penalties and the DST that should have been imposed on the instrument shall be paid by the covered institution upon notice and demand.

Download