Offline eBIRForms package (version 7.9.2) now available

(Revenue Memorandum Circular No. 111-2021 issued on October 20, 2021)

This Tax Alert is issued to inform all concerned taxpayers on the availability of the latest version of offline eBIRForms package (version 7.9.2).

The new version of the eBIRForms version 7.9.2 can be downloaded from www.bir.gov.ph and www.knowyourtaxes.ph.

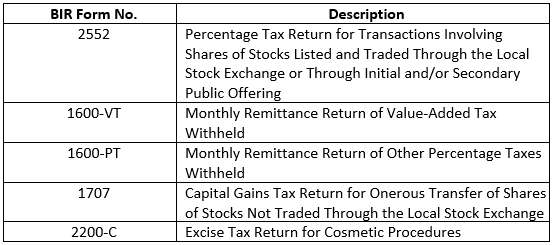

The new offline eBIRForms version 7.9.2 now includes the January 2018 version of the following forms:

The latest package also fixes the bugs for BIR Form Nos. 1702-MXv2018 and 1702MXv2018C.

Payments of taxes due can be made through the following modes:

1. Manual payment- Authorized Agent Bank (AAB) located within the territorial jurisdiction of the Revenue District Office (RDO) where the taxpayer is registered; or

In places where there are no AABs, the return shall be filed and the tax due shall be paid with the concerned Revenue Collection Officer under the jurisdiction of the RDO using the Mobile Revenue Collection Officer System (MRCOS) facility.

2. Online payment

- Thru Mobile Payment (GCash/Paymaya);

- Landbank of the Philippines (LBP) Link.BizPortal – for taxpayers who have ATM account with LBP and/or holders of Bancnet ATM/Debit Card;

- Development Bank of the Philippines Tax Online – for taxpayers who are holders of VISA/Master Credit Card and/or Bancnet ATM/Debit Card;

- Union Bank Online Web and Mobile Payment Facility – for taxpayers who have account with Union Bank; or

- PESONet through LPB Link.BizPortal – for taxpayers who have account with RCBC and Robinsons Bank.