Implementing rules and regulations of tax amnesty on delinquencies

(Revenue Regulations No. 4-2019)

This Tax Alert is issued to inform all concerned on the implementing rules and regulations of the Title IV (Tax Amnesty on Delinquencies) of the Tax Amnesty Act (RA 11213) which took effect today, April 24, 2019.

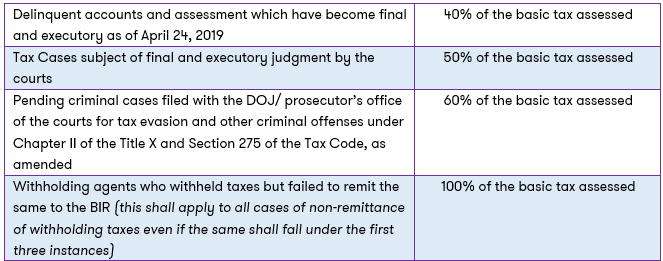

Pursuant to Revenue Regulations No. 04-2019, the tax amnesty on delinquencies may be availed until April 24, 2020 by all persons with internal revenue tax liabilities covering taxable year 2017 and prior years, under any of the following instances and applicable tax amnesty rates:

Tax delinquent account covers the following instances:

- Unprotested final assessment notice (FAN)/ final letter of demand (FLD);

- Final decision on disputed assessment (FDDA) which was not appealed to the CTA or before the CIR within 30 days from receipt of the decision denying the request for reinvestigation or reconsideration;

- Decision of the CIR denying taxpayer’s administrative appeal to the FDDA which was not appealed to the CTA within 30 days from receipt;

- Delinquent accounts with applications for compromise settlement whether denied or still pending with the REB/NEB;

- Delinquent withholding tax liabilities arising from non-withholding of tax; and

- Delinquent estate tax liabilities.

In cases where the tax delinquencies have been subject of application for compromise settlement, whether denied or pending, the amount of payment shall be based on the net basic tax (i.e. basic tax assessed less amount of compromise settlement paid and partial payment made prior to April 24, 2019).

In cases where the delinquencies consist only of the unpaid penalties due to late filing or payment, and there is no basic tax assessed, the taxpayer may avail of the tax amnesty on delinquencies without any payment due.

To avail of the tax amnesty on delinquencies, a Certificate of Delinquencies/Tax Liabilities must first be secured from the appropriate BIR office. The tax amnesty amount may be paid with the AABs or RCOs, whichever is applicable.

A Notice of Issuance of Authority to Cancel Assessment (NIATCA) shall be issued by the BIR to the taxpayer availing of the tax amnesty on delinquencies within 15 calendar days from submission of the proof of availment and payment of tax amnesty amount. Otherwise, the stamped “received” duplicate copies of the APF and TAR shall be deemed as sufficient proof of availment.

Availment of the tax amnesty on delinquencies shall be considered fully complied upon submission of the proof of availment and payment of tax amnesty amount within the one (1) year availment period.

For the documents required for the processing of tax amnesty application on tax delinquencies, please refer to the full text of the RR No. 04-2019.

If you have delinquencies covered under RR No. 4-2019, P&A Grant Thornton can assist you in securing the required certificate, preparing the prescribed forms, and processing the application.

Download