Guidelines and clarifications on the temporary reduction of percentage tax rate for the period from July 1, 2020 to June 30, 2023

(Revenue Memorandum Circular Nos. 65 and 67-2021 issued on May 24, 2021)

This Tax Alert is issued to inform all concerned taxpayers on the guidelines in filing and clarifications relative to the temporary reduction of percentage tax on persons exempt from VAT pursuant to Republic Act No. 11534, also known as Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act, as implemented by Revenue Regulations (RR) No. 4-2021.

Coverage of the reduced percentage tax rate

1. All persons, whether corporations or individuals, who are subject to percentage tax for not exceeding the VAT threshold of P3,000,000, shall be covered by the reduced percentage tax rate of 1% effective July 1, 2020 until June 30, 2023. Exceptions are cooperatives and self-employed individuals and professionals availing the 8% income tax rate who are exempt from percentage tax.

Claiming overpaid percentage tax

1. The reduction of percentage tax rate is effective on July 01, 2020. Taxpayers who filed their 3rd and 4th quarter percentage tax returns for taxable year 2020 and those who may have filed their 1st quarter percentage tax returns for 2021 using the 3% rate are required to amend their duly filed percentage tax returns using the 1% rate to reflect the overpaid taxes.

2. The amended percentage tax returns showing the overpayment shall be the basis for the carry-over. Thus, failure to amend the returns will result to disallowance of the carryover of the over-payment.

3. Amendments of percentage tax returns is not subject to penalty for affected taxpayers who will carry over the overpaid percentage taxes.

4. The carry-over of overpaid percentage tax option, which can be done until the overpaid percentage taxes are fully utilized, precludes the taxpayer from claiming tax refund for the overpayment. Refund is allowed for the following instances:

a. Taxpayer shifted from non-VAT to VAT-registered status; or

b. Taxpayer has opted to avail the 8% income tax rate at the beginning of TY 2021.

Filing of BIR Form 2551Q

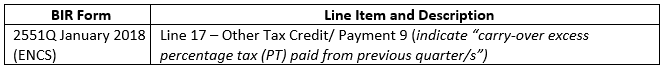

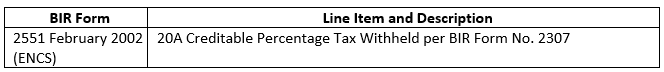

1. In filing BIR Form 2551Q, taxpayers should reflect the carryover of overpaid percentage tax in the returns as follows:

a. Manual and eBIRForms-users

b. eFPS-users

2. For purposes of the transitory provisions in Section 3 of RR No. 4-2021, it is presumed that the taxpayer will carry over the overpaid tax to the succeeding taxable quarter. Upon filing of amended percentage tax returns for 3rd and 4th quarters of 2020 and 1st quarter of 2021, taxpayers shall observe the following:

a. Manual filers shall not mark the options “To be refunded” or “To be Issued a Tax Credit Certificate” in the return but shall rather write the phrase “To be Carried Over”.

b. For eFPS and eBIRForms filers, the option “To be Issued Tax Credit Certificate” shall be marked as a workaround procedure to proceed with the electronic filing. However, if the taxpayer is allowed to refund the overpaid percentage tax and intends to apply for such, the BIR shall be informed thru BIR Form No. 1914 or the “Application for Tax Credits/Refunds” by indicating therein that it shall be in the form of refund or TCC.

3. If the taxpayer will carry over the overpayment but has inadvertently marked either tax refund or issuance of TCC in the return, the BIR will presume that the overpaid amount will be carried over. Once the overpayment has been carried forward, the option initially chosen shall automatically be superseded.

Other clarifications

1. For those who availed of the substituted filing of percentage tax under RMC No. 51-2018, the withholding agent/ government agency shall be responsible in refunding the overpaid taxes of individuals under job order or service contract agreements with the government. The government, its instrumentalities, LGUs, SUCs, including GOCCs and GFIs shall amend previously filed returns including respective alphalists. The reduction or resulting overpayment shall only be to the extent of the amount to be refunded.

2. Payments by the government to taxpayers subject to percentage tax shall be subject to withholding of percentage tax also at the reduced rate of 1%.

3. If the whole amount of 3% percentage tax has been claimed by taxpayer as deductible expense for purposes of computing income tax due, the taxpayer can no longer be allowed to carry over or apply for tax refund/ TCC the alleged overpaid percentage tax unless the ITR filed is also amended to reduce the percentage taxes claimed as expense.