Extended deadline for filing of BIR assessment letters and correspondences, and VAT refund applications falling due during the ECQ and MECQ period; suspension of the running of statute of limitations for the assessment and collection of taxes

(Revenue Memorandum Circular Nos. 92 and 93-2021 issued on August 09, 2021)

This Tax Alert is issued to inform all concerned taxpayers on the extended deadline for filing of letters, replies, position papers, protests, and documents related to on-going BIR assessments, and VAT refund applications falling due during the Enhanced Community Quarantine (ECQ) and Modified Enhanced Community Quarantine (MECQ) period, including extensions thereof, as well as, the suspension of the running of statute of limitations for assessment and collection of taxes during such period/s.

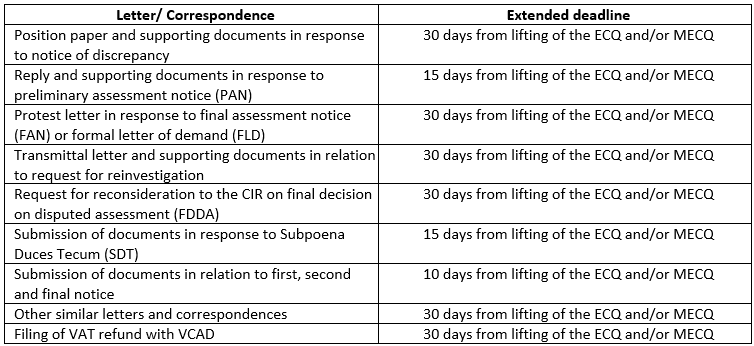

Extended deadlines are as follows:

Face to face meetings of BIR officials and employees with taxpayers and/or authorized representative in areas under ECQ/MECQ, are likewise deferred and rescheduled until lifting of ECQ and/or MECQ.

Moreover, the running of statute of limitations for assessment and collection of deficiency taxes is suspended in affected areas while ECQ and/or MECQ is in effect, and for sixty (60) days thereafter.

The above extension of deadlines and suspension of statute of limitation shall also apply in case of any future declarations of ECQ and/or MECQ by the government.

Download