Clarifications on the suspension of running of statute of limitations due to declarations of ECQ and MECQ in certain areas

(Revenue Memorandum Circular No. 80-2021 issued on June 29, 2021)

This Tax Alert is issued to inform all concerned taxpayers on the clarifications on the suspension of the running of statute of limitations for assessment and collection of taxes due to declarations of quarantine in various areas in the country.

The running of statute of limitations is suspended in areas placed under Enhanced Community Quarantine (ECQ) and Modified Enhanced Community Quarantine (MECQ). The suspension is equivalent to the number of days the particular area was placed under ECQ and MECQ, plus sixty (60) days from its lifting.

With such suspension, the concerned BIR offices shall be provided with additional days for them to issue the Assessment Notices, Warrants of Distraint and/or Levy, as well as Warrants of Garnishments, against taxpayers covered by the ECQ and MECQ declaration.

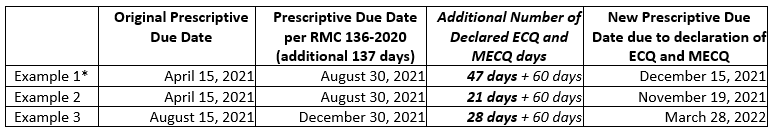

Illustrations:

* Based on the declaration of ECQ and MECQ for the period from March 29, 2021 until May 14, 2021 (47 days) in the NCR Plus. As a result, the statute of limitation was extended by additional one-hundred seven (107) days for taxpayers in the NCR Plus.

Download