New annual income tax and capital gains tax returns

This Tax Alert is issued to inform all concerned on the newly issued annual income tax returns (BIR Form Nos. 1700, 1702-RT and 1701-EX) and capital gains tax return (BIR Form No. 1707).

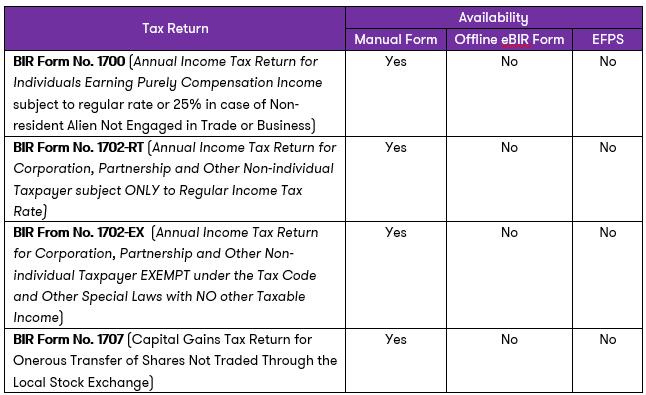

Aligned with the TRAIN Law’s requirement for simplified individual and corporation returns, the BIR issued the following January 2018 versions of income tax and capital gains tax returns:

Due to the unavailability of the revised forms in eBIRForm and EFPS, eBIRForm and EFPS filers shall still use the existing old versions of BIR Form Nos. 1702-RT, 1702-EX and 1707 available in eBIRForm and EFPS. While all filers of BIR Form No. 1700 shall use the manual return in filing and paying the income tax due thereon.

Manual filers shall download and print the PDF version of the form and fill up the applicable fields. Payment can be made manually with AABs or BIR’s Revenue Collection Office, or through the available online payment modes (Gcash, Landbank of the Philippines Linkbiz Portal, and DBP tax online).